Economy

/

December 9, 2024

A large majority of voters gave the Biden administration a failing grade on the economy. For the sake of future policy battles, it is worthwhile to try to understand their reasons.

One cannot fault Jared Bernstein, lead architect of “Bidenomics,” for feeling a measure of “guilt, confusion” over Donald Trump’s defeat of Kamala Harris in the 2024 election. Bernstein says—and I believe him—that the daily mission of Biden’s economists was to improve the lives of the American working class. Not to be rewarded with a vote of “Good job, and carry on” must be a bitter blow.

Yet there is very little evidence that disappointment with the economy decided the election. According to an NBC exit poll, only 6 percent of Biden’s 2020 supporters switched to Trump in 2024, and their numbers were partially offset by 4 percent of Trump’s 2020 voters who went to Harris. The difference is trivial, and we have no reason to think it was concentrated in the swing states; Trump gained far more ground in states where the outcome was not in doubt.

The fundamental driving force in this election was differential turnout. In a voting-eligible population that grew by 4 million, Trump gained 2 million votes while Harris lost 7 million compared to Biden in 2020. Moreover, Biden’s victory was a unique surge, many of whose sources can be traced to the pandemic. Perhaps the most important was the unprecedented ease of voting, thanks to measures which did not recur in 2024. But the precise motives of nonvoters are unknown; they do not show up in exit polls. Voter suppression—an endemic feature of American elections—differential voter mobility between election dates (poorer people and students move more), demographic turnover, and anger over specific issues all doubtless played a role.

That said, polls do establish that a large majority of voters gave Bidenomics a low grade. A sense of failure weighs on Bernstein and his colleagues, despite their good intentions and best efforts. They were repudiated—so say the polls—and for the sake of future policy battles, it is worthwhile to try to understand why.

It is no help to argue, as Paul Krugman did, that voters are not competent to judge their own interests and well-being. Krugman faults the voters, in effect, for failing to accept the superior wisdom of a columnist at The New York Times. But it is a precept of democracy (and of free market economics) that voters (and consumers) do know their interests. To refuse this precept is to deny the point of democracy, in which case there is no good reason to go on having elections. Or markets, either.

If voters are unhappy with the good readings on standard indicators—unemployment, the monthly inflation rate, economic growth—it must be because those indicators no longer connect to their sense of well-being. I have written on this before. In particular, low unemployment rates may reflect widespread disaffection with bad jobs; a low inflation rate does not reverse past price increases; and the incomes from growth may flow to profits and capital gains. These indicators are not useless—if they were bad, the situation would be even worse—but a good showing on them is insufficient.

Current Issue

What did happen under Biden was a decline in real incomes—in household purchasing power. Prices had risen sharply in 2021–22, and even though the inflation rate was transient—contrary to screams from economists—the change in price levels was not. Wages struggled to catch up. Many people living on savings and pensions never did. While the White House moved quickly to bring down gas prices with oil sales from the Strategic Reserve, it did little to stop firms from padding their margins. Profits surged, as did rents, land prices, and the stock market. The Biden economists had overlooked a fundamental fact, which is that the ultimate benefit of any “stimulative” policy flows to those with market power—to land and to capital—regardless of how it may be distributed at first.

In his interview with The New York Times, Bernstein accepted Larry Summers’s critique that Biden’s early fiscal policy had been too loose, unleashing inflation. But that critique was wrong then and it’s still wrong. Summers’s argument rests on a notion of working households living hand-to-mouth who would presumably rush to the grocery (and to the bars) with any extra cash they might receive. American households no longer function that way. They have budgets, bills, bank accounts, and habits. They took Covid relief as the buffer it was meant to be, saved what they did not need at once, and drew down those savings over time. Increased consumption (and investment in durable goods, like new cars and houses, as well as stocks and land) was largely limited to wealthy households, who were not the main recipients of Covid aid. Such households had free cash because they couldn’t spend their existing incomes, as they normally would, on services. And they had the extra benefit, for a time, of ultra-low interest rates.

Pressure from voices like Summers led to an early curtailment of direct Covid relief, which fell just as prices rose. It is a shocking fact that while during Covid child poverty rates and food insecurity declined, those rates returned to pre-Covid levels when the benefits ended. Should we really be surprised that the affected families, having briefly tasted a better life for their children, were unhappy?

At the same time, jobs were beginning to come back—but what jobs? In economic mythology, American life centers on work—on character-building, strength-testing, skill-demanding engagement with the physical world, on the farm, the range, the factory, the construction site or the open road. But most jobs today aren’t like that; practically all new jobs in America for the past 60 years have been in services—in shops, offices, restaurants; in accounting, bookkeeping, maintenance, and other minor professions. Most such jobs are neither secure nor well-paid, and it often takes two or more to sustain a middle-class household. Costs of commuting and child care make many secondary jobs barely profitable to hold. Covid relief and enforced unemployment gave many Americans a break, which they used to reassess their relationship to work. Many decided not to return, which is why the jobless rate fell and remained low, even though the employment-to-population ratio never fully recovered.

As the economy began to open up again, employers needed workers. Vacancies rose. What to do? The option of raising wages (and improving working conditions) is never attractive, since the gains must be given to all workers, not merely those newly hired or rehired. The alternative is to put a squeeze on those who have left the labor force until they feel the pinch and come back, hat in hand, seeking a job. And this could be done, with the complicity of the Biden team, by letting Covid benefits expire, and by hiking interest rates. Price increases, directly boosting profits, also added to the pressure on the not-employed. Is it a surprise that people do not like being pressured to take “bullshit jobs”?

Meanwhile, Biden’s policies aimed at industry, infrastructure, and the environment came into play; so did the endless flow of weapons for Ukraine. Whatever the long-term merits (or demerits) of these programs, their political impact was next to nil. Infrastructure goes unnoticed except as an annoying obstacle to the daily commute. Energy (if it works) feeds into an existing grid and arrives invisibly. American chips and other artifacts of the great “war” with China evoke no pride among ordinary consumers of the smartphone. Why should they? The total growth of manufacturing jobs since 2020 has amounted, so far, to at most a few hundred thousand—scarcely a month’s normal growth of jobs in America. Construction jobs are up by about 800,000—but many of those are filled by migrants. There is almost no visible positive effect on any part of American economic life, outside the market caps of a few companies—which, like all companies, are owned mainly by the rich.

The final and fatal blow to Bidenomics was the support given by the White House to the Federal Reserve, once the central bank started raising interest rates in March, 2022. Early on, President Biden gave his blessing—“Fighting inflation is the Fed’s job”—while also ducking his own responsibility to act against surging prices. Interest rates proved irrelevant to the “inflation fight”—they failed to slow economic growth or goose unemployment—but they froze up the housing market, made life miserable for small business, and undercut the viability of long-term investments, including renewable energy projects. Meanwhile, vast sums flowed in payments to banks on their reserves and to the tiny minority with large holdings of Treasury bills. The Biden economists never challenged these arrangements. They hewed to the craven orthodoxy, dominant among Democrats since the time of Robert Rubin, that the Fed’s independence is sacrosanct. But the entire point of an “independent” central bank is to defeat any economic program that serves the people to the inconvenience of Big Finance.

To be fair, since at least the 1990s all Democratic administrations have been paralyzed by the schizoid division of the party itself. Democrats have come to depend on funding from oligarchs—in banking, technology, entertainment, and other elite sectors. Votes, however, must still be gathered from low-income (and especially minority) communities, who form a large part of what is called the American “working class.” But except in extraordinary conditions this group gets little from the government (apart from pandering to identity), and what it does get—for instance, the Earned Income Tax Credit—is often as invisible as possible, to minimize political opposition. The pandemic allowed a dramatic exception, briefly revealing how conditions could be transformed by a radical policy. But instead of capitalizing on this event, Biden’s team steered for a return to normal. Meanwhile, Biden pursued an aggressive campaign of confrontation and escalation in Ukraine and the Middle East, as well as the economic combat with China—unwinnable wars on three fronts.

So while I do not think it fair to blame Bernstein and his colleagues for the Harris defeat, that most Americans do not think of the Biden years as an era of happy prosperity should be no surprise.

Popular

“swipe left below to view more authors”Swipe →

More from The Nation

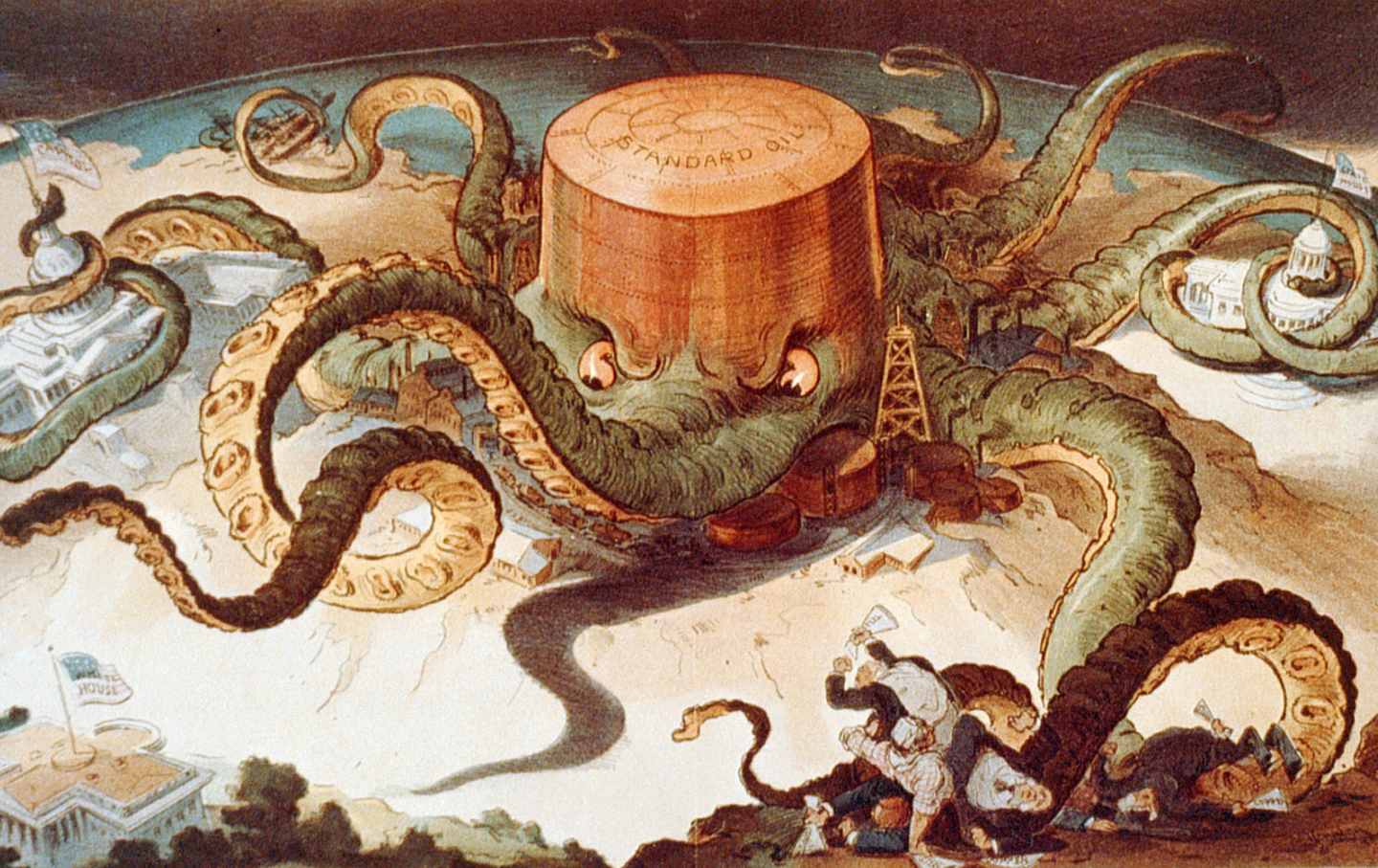

How the press keeps us in the dark about the new Gilded Age.

Michael Massing

New regulations are designed to expand the number of employees entitled to overtime. But the conservative courts have other ideas.

Emmet Fraizer

Contract negotiations have brought higher pensions, mandated rest times, and increased wages for a job that requires intense schedules and years of training.

StudentNation

/

Lucy Tobier

Moving resources and skills and jobs from the military-industrial complex to civilian sectors is a big project. But it could start in your own community.

Frida Berrigan

Matt Bruenig writes that governments should nationalize more companies while Zephyr Teachout argues that freedom requires decentralized power.

The Debate

/

Matt Bruenig and Zephyr Teachout